Higher mortgage rates haven’t increased inventory | SkipLeadPro

Last week, mortgage rates hit a 21st-century high, the 10-year yield closed slightly higher than my peak forecast for 2023, and housing inventory growth was still slow. Purchase application data didn’t budge much on the week-to-week data.

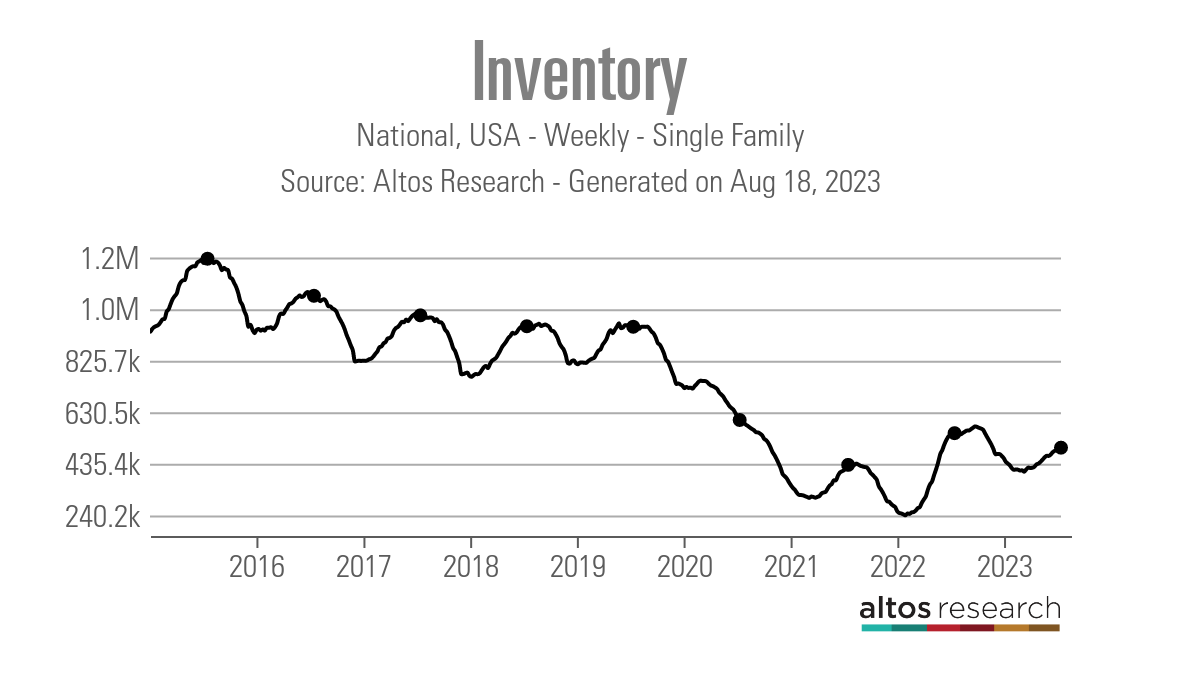

- Weekly active listings rose by only 4,401.

- Mortgage rates went from 7.19%% to 7.37%.

- Purchase apps were flat week to week.

Weekly housing inventory

Mortgage rates have been near or above 7% for the last few months, and active listings growth has been slow during this tenure. I had anticipated active listings growth to be between 11,000 to 17,000 per week with rates this high, and it hasn’t happened. I will keep a close eye to see if the country can achieve some decent weekly active listings data before the seasonal decline in inventory. Last year, the seasonal decline took longer than usual, but 2022 was an abnormal year with mortgage rates.

- Weekly inventory change (August 11-August 18): Inventory rose from 492,140 to 496,541

- Same week last year (August 12 – August 19): Inventory rose from 550,175 to 551,458

- The inventory bottom for 2022 was 240,194

- The inventory peak for 2023 so far is 496,541

- For context, active listings for this week in 2015 were 1,211,841

As noted above, active listings have been negative year over year for some time now, and we are heading toward a seasonal decline. Will higher rates extend the inventory season, or are we going into the traditional seasonal decline?

The new listing data has been trending at the lowest levels ever for over 12 months now. Hopefully, we will have found a bottom in this data line before the year ends. This data line is very seasonal, and we’ve already started the seasonal decline. As long as we see an orderly drop toward the end of the year, I will be happy. The last thing we want to see is more sellers calling it quits faster than the current trend.

Here’s how new listings this week compare to the same week in past years:

- 2023: 60,295

- 2022: 68,167

- 2021: 80,898

Mortgage rates and bond yields

It was a crazy week with mortgage rates as we hit a 21st-century high last week, with mortgage rates hitting 7.37%. To understand how I look at mortgage rates, the Fed, and the 10-year yield, I wrote this article last week to give a more detailed view. This topic was so “en vogue” this last week that CNBC asked me to open their Squawk Box show Friday morning to go over the issue. Here is the video clip of that interview.

With all that’s happening in the market, what should we focus on this week? For me, it’s straightforward — to see if we could break above 4.34% on the 10-year yield, which was the intraday high last year. The 10-year yield didn’t even touch 4.34% last week, and we closed the week at 4.25%.

Purchase application data

Purchase application data was flat last week, making the count year to date at 14 positive and 16 negative prints and 1 flat week. If we start from Nov. 9, 2022, it’s been 21 positive prints versus 16 negative prints and one flat week. While home sales aren’t collapsing like they were last year, they’re not growing with mortgage rates this high. Purchase apps are forward-looking for 30-90 days, which means home sales will be stuck near 23-year lows for the rest of the year.

The week ahead: Home sales and the fed

Next week, we have existing and new home sales reports. These two reports will show one big difference in 2023 compared to last year, new home sales are growing yearly while existing home sales still show negative year-over-year prints. This trend should continue this week.

As we head toward the end of the year, we have to remember that last year at this time, home sales were collapsing. So, the year-over-year declines will be less for existing home sales, and new home sales will show solid growth.

On August 25, we have the Federal Reserve’s meeting in Jackson Hole, which is very interesting. At this point of the cycle, higher rates aren’t something they want to see as they have stated they believe they’re in restrictive policy now. I will be curious to hear if Jay Powell admits that higher rates would not be something the Federal Reserve wants to see now.